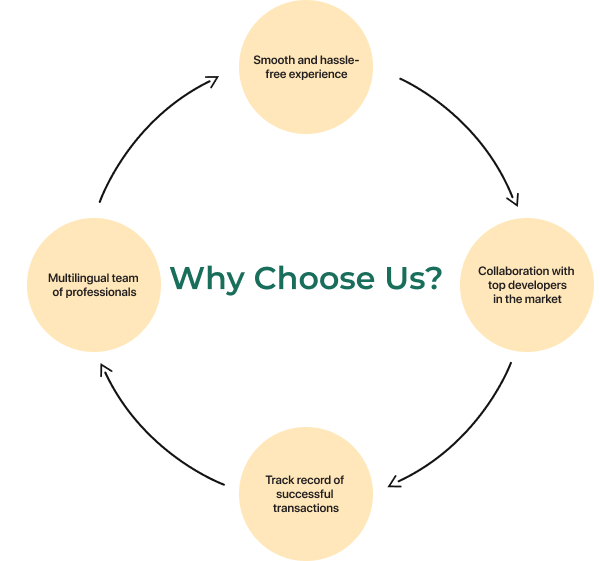

At Roots Land Real Estate, we specialize in guiding you through every step of your property purchase journey in Dubai. Our commitment is to make your buying experience both pleasurable and trouble-free.

Our expertise covers high-demand residential areas such as:

You can buy a variety of properties in Dubai, including studio apartments, 1-3 bedroom apartments, penthouses, villas, townhouses, and commercial properties such as offices and retail shops.

Yes, foreigners can buy property in Dubai in designated freehold areas. These areas include popular locations like Downtown Dubai, Dubai Marina, Palm Jumeirah, and JLT-Jumeirah Lakes Towers.

Popular areas for buying residential properties include Downtown Dubai, Dubai Marina, Palm Jumeirah, JLT-Jumeirah Lakes Towers, and Jumeirah Park. For commercial properties, Business Bay and DIFC are highly sought after.

Our expert team guides you through every step of the buying process, from property search and viewings to negotiations and finalizing the purchase. We offer a diverse portfolio of properties and provide personalized assistance to ensure a smooth and successful transaction.

Typically, you will need a copy of your passport and a valid visa. Additional documents may include proof of funds, a signed sales agreement, and identification for verification purposes.

The buying process generally involves the following steps:

While not mandatory, it is advisable to hire a lawyer to ensure all legal aspects of the transaction are handled properly and to protect your interests.

Yes, expatriates can obtain mortgages from banks and financial institutions in Dubai. Requirements may vary, but generally, a good credit history and proof of income are necessary.

Fees typically include:

A No Objection Certificate (NOC) is required from the developer to confirm that there are no outstanding service charges or issues with the property. It is necessary for the transfer of ownership.

A Memorandum of Understanding (MoU) is a preliminary agreement between the buyer and seller outlining the terms and conditions of the sale. It is signed after the price and conditions are agreed upon and usually requires a 10% deposit from the buyer.

The entire process, from signing the MoU to transferring ownership, typically takes between 30 to 60 days, depending on the complexity of the transaction and financing arrangements.

Yes, buying off-plan (under-construction) properties is common in Dubai. This allows buyers to purchase properties at pre-construction prices, often with flexible payment plans. Ensure you buy from reputable developers to minimize risks.

There are generally no restrictions on reselling freehold properties. However, if you buy an off-plan property, the developer may have specific conditions or a minimum holding period before resale.

Benefits include tax-free income, high rental yields, strong capital appreciation potential, and a stable and regulated real estate market. Additionally, Dubai offers a strategic location, world-class infrastructure, and a high quality of life.